Everyone knows you need a home loan buying yet another household or refinance an existing that, but the majority people do not lay a great amount of envision on financing officer they like. This may also be the first occasion you’ve got been aware of a loan officer.

Such all other career, loan officers keeps specific experience. There are many different mortgage loans available to you and various borrowers with different mortgage means, thus selecting the right financing officer to complement you with the best home loan is needed whenever you initiate the home-to acquire procedure.

What Properties Would you like when you look at the that loan Officer?

That loan manager works well with a bank otherwise mortgage lender so you can let homeowners sign up for financing once an evaluation of the financial situation . There is no you to-size-fits-the approach to obtaining a home loan. This is why i have mortgage officers that will get the ideal version of loan to suit your needs, needs loans Nances Creek, and life.

Experience with the field

Like most almost every other employment, the loan officer’s sense commonly suggest the level of skill. When shopping for an officer, please ask about the experience. Its also wise to look into its company, because other mortgage businesses can offer some other mortgage designs.

You can also imagine obtaining the mortgage officer’s All over the country Multistate Certification Program (NMLS) number and seeking it up and see any grievances generated facing her or him .

Expertise in Various types of Mortgage loans

Towards level of mortgages offered, we want to make sure your financing officer practical knowledge with the type of mortgage you want, instance compliant , regulators , jumbo , or refinancing finance.

If you aren’t sure just what form of mortgage is best suited for your, the loan manager need experience handling consumers inside comparable monetary situations.

Prompt Control Date

Getting financial recognition on time should be a major cause of if you order property ahead of most other interested people. Running time will not usually fall into the financing officer, but instead into form of mortgage. Eg, a great jumbo mortgage needs one minute underwriter, meaning the brand new running big date is oftentimes over a month. Make sure to pose a question to your financing officer upfront on handling times for every loan.

Fluent Financial Evaluation

Your financial paperwork is the most crucial bit of information when searching approval for a financial loan. The loan administrator need securely see your income tax come back or any other necessary papers. One small mistakes you could end up this new assertion out-of that loan.

Tech Knowledge of Automation Softwares

Progressive financing officials should be pros that have state-of-the-art apps you to optimize the method, such as for example financing origination possibilities. This enables these to invest longer in order to meet your aims.

Good Customer care and you may Communications Event

Mortgage officers don’t just work on members-however they work at real estate professionals, builders, term enterprises, appraisal enterprises, and you can operating, underwriting, and you can closure divisions, so they really need expert customer care and you will communications event.

What are financing Officer

Though it isn’t really necessary to companion that have a district lender, there are many experts in the integrating having somebody who has a beneficial solid put of your own home:

A personalized Experience

Having the ability to fulfill face to face with your financing administrator offer reassurance that they are not far off. And, when your financial is found in their city, you have got a much better opportunity out-of reading from the somebody’s experience functioning together with them firsthand.

Local Possibilities

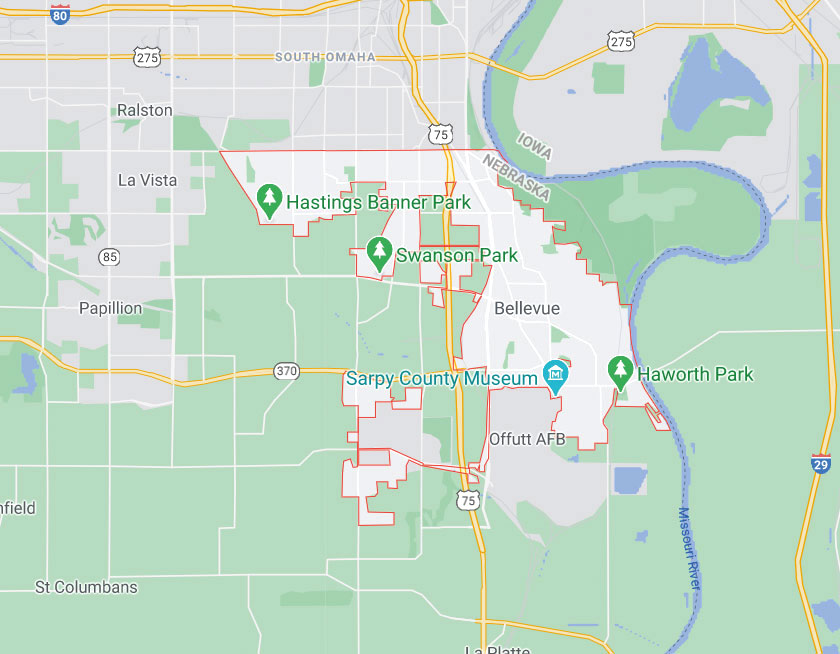

An additional benefit at your workplace with an area financing administrator is the focus on regional field criteria. A local financial knows about the newest class and you will history of brand new city, and additionally economic style that can make it easier to get a loan compared to a nationwide bank.

Strong Relationship that have Real estate agents

Your own real estate professional along with your loan officer work together to assist you in finding the best house. If you find just the right house or apartment with your real estate agent, they’re going to then correspond with the loan manager locate approval quickly.

See that loan Administrator at the radius

Need a loan manager with solid correspondence and customer support feel, tech systems, and local awareness, and you can find on distance. radius is a consumer-obsessed financial which have Mortgage Officials who’ll meets your on the better mortgage for your disease.