There are 2 methods for you to get assets within the Dubai which have bucks otherwise into a home loan. If you’re a funds money are overall more pricing-effective, home financing allows you deeper independence regarding the manner in which you take control of your profit. Should you decide to shop for a property towards the a mortgage when you look at the Dubai, you are needing to understand how home loans on emirate performs and you may all you have to do in order to have one. I’ve including recently released an on-line effort to find good mortgage preapproval in partnership with ADCB, to make the procedure a whole lot more sleek getting prospective people. If you’ve been selecting information on mortgage Dubai’, financial rates Dubai’ and other comparable topics, find out about the latest ADCB Dream Household effort as well as how your could possibly get home financing with the help of our in depth article!

Who can Qualify for Mortgage From inside the DUBAI?

If we need to pick a flat into the Dubai otherwise was inclined to the a villa otherwise townhouse, you can easily safe a home loan for it, offered you meet with the qualifications requirements. You could apply for home financing for the Dubai if you’re:

- A good UAE federal otherwise citizen

- Aged ranging from 21 and you can 65

- Possess a monthly income regarding AED 15K (salaried) and you can AED 25k (self-employed)

Create observe that minimal income to own a mortgage inside Dubai may vary in accordance with the lender. Certain finance companies allow UAE nationals which have a monthly money off within minimum AED 8k to apply for lenders from inside the Dubai, but it’s mostly personal to help you financial regulations.

Non-people can also explore home loan possibilities for the Dubai. However, their options are mainly restricted once the not many financial institutions handle home loans to possess non-resident possessions people.

Please be aware you to banking companies could have even more standards to own financial eligibility eg minimum months served from the newest job otherwise employed by a certain gang of businesses, etcetera.

Just what Data Have to See Home financing In DUBAI?

Anybody who wants to pick possessions for the financial, has to basic make an application for you to. Obviously, there was documents needed to process home financing application into the Dubai. Certain requirements can differ slightly in one financial to a different, however for the absolute most area, you need the next data to try to get a mortgage when you look at the Dubai:

- A duplicate of visa and you can passport

- A copy of your Emirates ID

- A salary certificate having proof of work

- Proof of home (backup out of tenancy offer or DEWA statement)

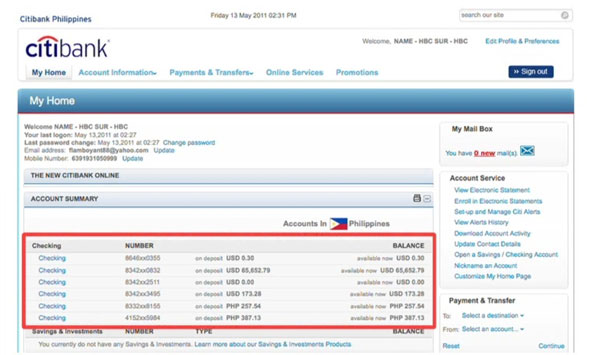

- Shell out slides and you will bank comments for the past six months

- The newest statements of your own credit cards

The way to get A mortgage In the DUBAI?

Want to buy property within the Dubai with funding? Right here is the done action-by-step procedure of taking a mortgage to finance your house purchase:

Step one: Look for A loan provider

When you look at the Dubai, mortgage loans is sourced using finance companies and really should feel registered that have the Dubai Homes Institution (DLD) to-be legally legitimate. You bad ceedit loan in Evergreen could potentially privately method your own lender for their readily available mortgage profit otherwise hire an agent to be hired in your stead to track down a knowledgeable home mortgage within the Dubai.

Home loans keeps indispensable sense and you will experience with your neighborhood business and readily available home loans which could work for you. This permits you to interest your time and effort towards the locating the best family rather than delivering involved and you can lost on the whole financial processes.

2: Choose the right Financial To you personally

You can find different kinds of mortgages during the Dubai. They mainly fall into the new categories of fixed-speed and you will changeable-rates mortgage loans. There are many situations you should thought whenever determining what variety of home loan excellent for your items. This type of facts tend to be, however, commonly simply for: