This shed don’t arrive immediately, but you’ll view it advertised within this a small number of days of the closure in the event your lender reports the first commission. Normally it requires about 5 months so your score will go back right up if you make repayments timely, and in case your whole borrowing from the bank designs stay good.

Normally that loan end up being declined shortly after completion?

Sure, you can nevertheless be rejected shortly after being approved to own closing. When you are obvious to close off ensures that the brand new closure time is actually addressing, it does not indicate that the lending company cannot go out of organization. You could recheck the borrowing from the bank and you can a position reputation just like the this has been a lot of go out since you used for the financing.

What’s the average credit rating?

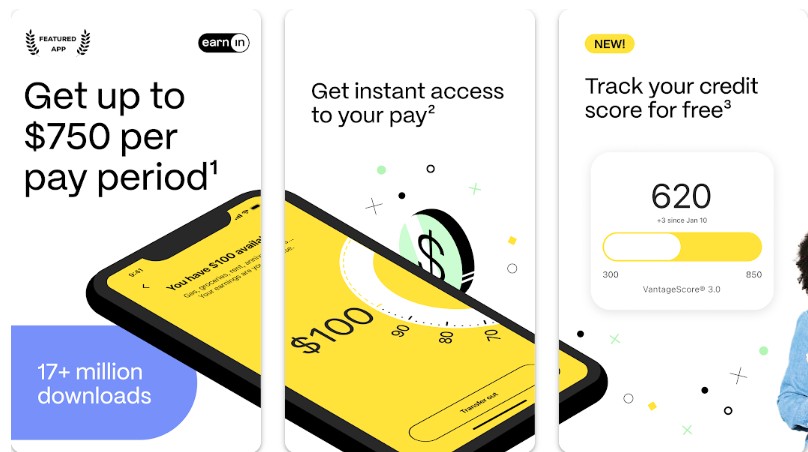

The typical credit score in the us is actually 698based with the Vantage Rating Investigation from . It is a misconception which you only have that credit history. In fact you’ve got of a lot credit scores. It is preferable to evaluate your borrowing from the bank on a regular basis.

Must i have fun with my credit card when purchasing a house?

Consumers can be continue using their charge cards during the home financing transactionbut you need to be aware of new timing and never make sales during the time whenever closing the loan you’ll completely derail, advises Rogers.

Have a tendency to to get a car or truck connect with my chances of taking a home loan?

To buy a car in addition to expands your debt weight, making you arrive given that good riskier borrower. That will signify mortgage brokers are you currently try more unlikely so you can agree an interest rate. And in case you take on highest costs particularly a car loan, you are faster capable spend the money for family commission your need.

Vehicle people and you may lenders supply borrowing from the bank requirements and an affirmation processes, but they are generally much more easy than just mortgage insurance companies. You really won’t have an issue to get an automobile just after to acquire a house when you have a good credit score and cash immediately following to order your residence.

If you have only finished buying property consequently they are thought good auto loan, you might wait for laws that financial are off or if you don’t have the secrets to our house. Allow within a minumum of one full business day after achievement prior to opening a separate financing may also ensure that your mortgage provides become funded and you will paid back.

How to improve my credit history from the one hundred facts into the thirty day period?

- Pay all debts on time.

- Learn more about delinquent repayments, in addition to fees-offs and you can range profile.

- Repay charge card stability and keep him or her low according to their borrowing limitations.

- Apply for borrowing only if needed.

- Do not personal old, bare credit cards.

If your credit score was at least 643 while satisfy other standards, you have zero issues bringing a mortgage. … The types of software offered to consumers having a credit score from 643 try: traditional funds, FHA money, Virtual assistant loans, USDA financing, jumbo finance, and low-finest fund.

Simply how much deposit manage Now i need to personal loan for immigrants possess a house?

In most cases needed in initial deposit away from 20% 25% to qualify. When you yourself have a credit score higher than 720, you can also qualify for a financial investment mortgage within a good 15% disregard. FHA Mortgage: You cannot explore an FHA financing buying a residential property.

Immediately following conclusion, can be the lender look at the creditworthiness?

Until the financial tells you you are clear to your bargain, you might still provides an excellent conditions to deal with, and additionally a potential supplementary borrowing from the bank comment. … Extremely, but not all the, lenders commonly double-check your own credit which have good mellow loan demand. inside seven days of estimated closing day their home loan.

Do it lso are-work with your loan on the personal?

A question of many buyers possess is whether or not a loan provider commonly eliminate their borrowing more often than once from inside the pick techniques. The clear answer are yes. Lenders collect the latest borrower’s financing at the beginning of the brand new approval process and you can but ahead of achievement.